Los Angeles Installment Loans | Bad Credit Options

Los Angeles installment loans sent direct to your account. Even if you have bad credit you may still be approved.

Bad Credit Loans in Los Angeles

So, you are in the middle of a major financial crisis and need urgent cash but your credit is bad. However, the problem is that your credit history is not that impressive and you are absolutely certain that no bank will grant you an installment loan on the basis of your bad credit. Then what do you do?

Well, in this case, one of your options would be a Los Angeles installment loan that is available in California. Also available in San Diego and San Francisco.

What is a bad credit installment loan?

Bad credit installment loans are typically provided for a short period of time within which the borrower has to repay the entire principal and interest amount to the lender.

One advantage of an installment loan is that you know exactly how much your loan will cost and when it will be paid off, it does not rollover like a cash advance. Since bad credit loans are typically offered for a smaller amount, it is easier for you to repay your monthly loan installments without fail.

Most lending companies in Los Angeles, California offer online loan applications for bad credit loans, you can easily access funds with just a few clicks on your laptop or smartphone.

Los Angeles Direct Deposit Loans

Our lenders will send the money direct deposit when you are approved. Since bad credit loans in California do not involve extensive background checks or paperwork, most disbursements are completed within a short span of time, a few days or even a few hours!

More About Los Angeles, California

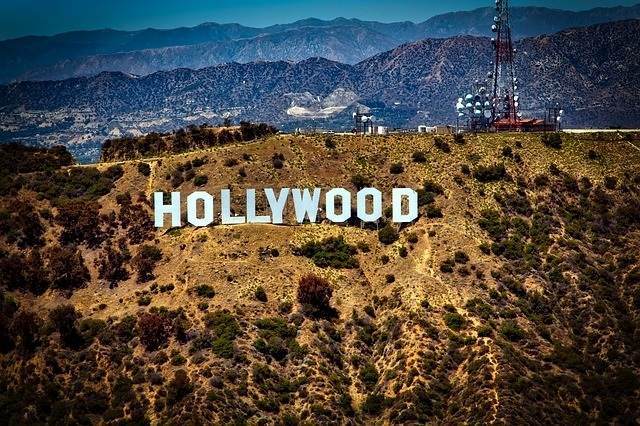

Home of Hollywood, the beautiful city of Los Angeles can be rightly touted as the commercial, financial, and cultural hub of Southern California. Also known as the ‘City of Angels’ L.A. is famous for its Mediterranean climate, warm winter sun, sprawling metropolis, cultural diversity and the jasmine-scented dreamy hillsides.

Some of the major tourist attractions in L.A. that are regularly flocked by tourists and travelers from around the world includes the Universal Studios Hollywood, Getty Center, Griffith Park, Disneyland, Walt Disney Concert Hall, Santa Monica Pier, and the Runyon Canyon Park.

How to improve a poor credit score in LA.

A good credit score not only helps you avail easy debt financing at low interest rates, but also allows you to save hundreds of dollars on security deposits and insurance of mobile phone and other utility services.

Your credit rating is a direct reflection of your financial credibility and capacity to make timely payments of your monthly bills. So, how do you build and maintain a strong credit background? Have a look!

Personal Loan Amounts: $100 | $255 | $500 | $1000 | $5000

Ensure timely payments A good payment history is the holy grail of ensuring your creditworthiness. Your credit rating is calculated by a cumulative scoring of a number of different factors out of which the highest proportion (nearly 35%) comes from your history of debt repayments in the past.

It is therefore enormously important to pay off all your credit card balances and loan EMIs on or before their respective due dates.

Understand your credit score and what it means.

While it is extremely difficult to actually evaluate your credit score using the complex formulas that most lenders use, you must at least have an idea about what goes into building or breaking it.

There are largely five categories including payment history, amounts owed, length of credit history, types of debts owed and new credit that are considered while determining your credit rating.

If you are aware of the factors that are likely to influence your creditworthiness, you can take adequate steps to keep them as positive as possible.

How does a Los Angeles installment loan work?

If you need an $1000 installment loan in Los Angeles, first you need to complete the loan application, click Apply to get started. Then if we can match you with a lender you will receive an installment loan offer.

If you like the terms of the loan you can choose to accept it and the funds will be ACH'd to your account. Generally on the next business day.

What is a Installment Loan?

It is basically a short-term loan that the lender provides you without making any thorough checks of your credit history, the payments are made monthly and include principal and interest.

Since these bad credit loans can also be procured with a poor credit score or no credit whatsoever, the lender runs a high risk of having to bear an eventual default on the borrowed amount.

It is for this reason that these high-risk loans typically have a higher rate of interest as compared to the long-term loans that require the borrower to meet the basic requirements of credit-worthiness.

Try to Keep Your Credit Card Balances Below Your Credit Limit

Your available credit limit can drastically impact your creditworthiness if it is on the verge on being maxed out. The available credit is basically the amount of credit that is left over after you have used a certain portion of your total credit limit.

Experts say that you must keep your credit card balances low in proportion to the total credit limit offered by your issuer. For instance, it is a good idea to use only 30% of your overall credit limit.

Refrain From Applying for Loans or Credit Cards that You Do Not Need

One major aspect of your credit score evaluation is your recent credit activity that involves all the new credit that you have availed recently.

Opening several credit accounts over a short span is indicative of a probably financial setback that you may be suffering from.

This is fairly unhealthy given the fact that your lender might be led into thinking that since your financial health is currently not sound you might not be able to repay any additional debt as well.

How the personal loan process works

One you apply your application will be processed by our network of direct lenders. If one decides to offer you a loan you will immediately receive that loan offer.

At that point, it is up to your to decide if you wish to accept or decline that loan offer. All terms are between you and the lender, not WireLend. Here's a list of items to have ready when you start the application.

- Photo ID

- Proof of Income

- Proof of Residence

- Checking Account Number and Routing Number